S1 60k wallstreetbetsleebloomberg” probably refers to a story about a Form S-1 filing, a $60,000 trading event, and the WallStreetBets. It might also involve Bloomberg reporting on it, with “Lee” possibly being a trader or person involved in the event.

Stay tuned as we explain the story behind S1 filings, the $60k trade, WallStreetBets, and what Bloomberg has to say. More to come!

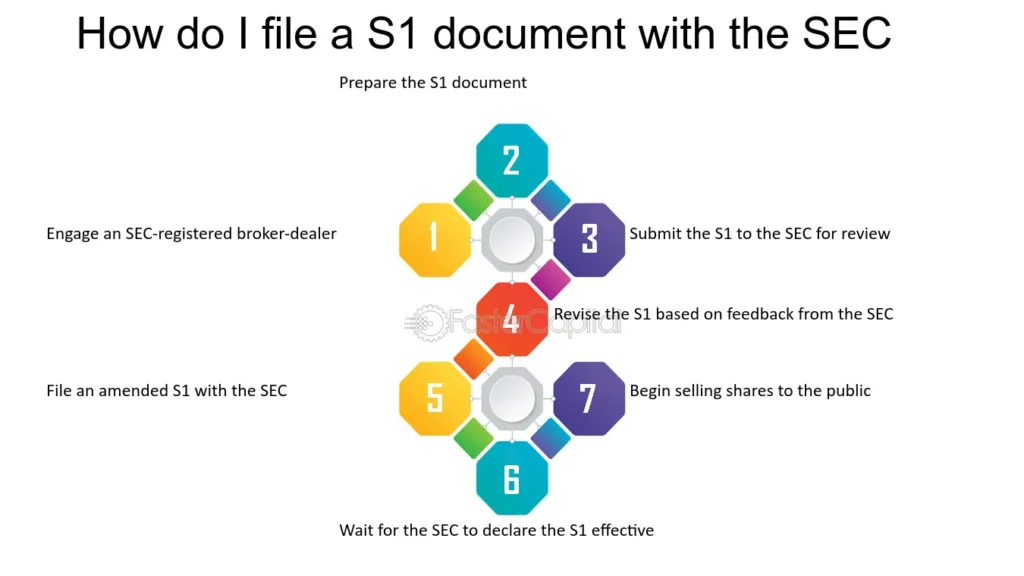

What is an S-1 filing?

An S-1 filing is a document a company submits to the government when it wants to sell shares to the public for the first time (called an IPO).

It shares important information about the company, like its finances, business plans, and risks, so people can decide if they want to invest.

What does 60k refer to in the context of WallStreetBets?

In the context of WallStreetBets, 60k usually refers to a $60,000 amount. It could be a profit, loss, or the size of a trade that a member is talking about. For example, someone might share that they made a $60k gain or lost that much in a stock trade.

What is WallStreetBets (WSB)?

WallStreetBets (WSB) is a Reddit group where people talk about risky stock trades, sharing big wins or losses. It got famous for boosting stocks like GameStop and AMC (American Multi-Cinema) The group became a symbol of retail investors challenging Wall Street and large institutions.

How does Bloomberg relate to WallStreetBets?

Bloomberg is a big news company that talks about finance. It covers what’s happening in the stock market, including the actions of WallStreetBets (WSB). When WSB members push stocks like GameStop or AMC, Bloomberg reports on it and explains how it affects the stock market.

What connection does 60k have to an S-1 filing?

The 60k connected to an S-1 filing might refer to a $60,000 investment or profit related to a company planning to go public. When a company files an S-1 form, it’s getting ready to sell shares for the first time.

People in places like WallStreetBets might talk about how much money they’ve made or invested in these companies during this process.

Why is WallStreetBets significant in stock trading?

WallStreetBets (WSB) is important in stock trading because it’s a group of regular people who make big, bold trades. They made headlines by pushing up stocks like GameStop and AMC, showing that everyday investors can have a huge impact on the market.

What type of traders are active on WallStreetBets?

Traders on WallStreetBets are mostly regular people who take big risks with their money. They share stories of big wins and losses and love making bold trades. It’s a place where they support each other and celebrate their successes (or laugh off their failures).

How reliable is Bloomberg for financial news?

Bloomberg is a trusted source for financial news. It provides accurate and up-to-date information about the stock market, companies, and the economy. Many people in finance rely on Bloomberg for its clear and detailed reports.

What is the relationship between WallStreetBets and IPOs?

WallStreetBets gets excited about IPOs when companies start selling shares to the public. They often talk about these new companies and share their thoughts, hoping to make big profits. It’s a place where people jump on opportunities and discuss the potential for big gains.

How can I track IPOs like WallStreetBets traders?

To track IPOs like WallStreetBets traders, you can:

- Follow financial news:

Websites like Bloomberg and Yahoo Finance will keep you in the loop about upcoming IPOs.

- Check S-1 filings:

When companies plan to go public, they file S-1 forms. You can find these on the SEC website to get the inside scoop.

- Use stock apps:

Apps like Robinhood or WeBull will notify you when new IPOs are happening.

- Join online groups:

Check out WallStreetBets on Reddit, where traders talk about upcoming IPOs and share tips.

- Sign up for IPO alerts:

Some websites send notifications or emails to let you know when new IPOs are coming your way.

Why are people on WallStreetBets interested in S-1 filings?

People on WallStreetBets are interested in S-1 filings because they give important information about companies planning to go public. These filings show things like the company’s money situation and business plans, helping traders find companies that could make big stock gains after they start selling shares.

How does WallStreetBets handle losses?

WallStreetBets handles losses with humor and a positive attitude. People often joke about their mistakes or risky bets that didn’t pay off. The group supports each other, whether they win or lose, and they see losses as part of the process, laughing it off and moving on.

What makes WallStreetBets different from other investment groups?

WallStreetBets is different because it focuses on risky trades and big, quick profits. People there share their wins and losses in a fun, joking way, unlike other groups that focus on safer, long-term investments.

How can I join WallStreetBets?

To join WallStreetBets, make an account on Reddit and search for r/WallStreetBets. Once you find it, you can start reading posts and join the discussions. Feel free to ask questions and share your own stock ideas with the community.

Why do people on WallStreetBets sometimes bet against stocks?

People on WallStreetBets bet against stocks, called short selling, when they think the stock price will go down. They sell the stock now and plan to buy it back later at a lower price, hoping to make money if the price drops.

Read: /Redandwhitemagz.Com – Everyone Need To Know!

Frequently Asked Questions:

- Why are memes important in WallStreetBets?

Memes are important in WallStreetBets because they make discussions fun and help traders bond over shared experiences, wins, and losses in the stock market.

- What does “tendies” mean on WallStreetBets?

“Tendies” is a term used for profits or money made from trading stocks. It’s often used humorously when traders talk about their gains.

- How does WallStreetBets affect the stock market?

WallStreetBets can cause big changes in stock prices, especially when many traders on the subreddit buy or sell the same stock at once, causing prices to spike or crash.

Conclusion:

S1 60k WallStreetBetsLeeBloomberg shows how financial filings, bold trades, and online communities like WallStreetBets are changing the stock market. From talking about S-1 filings to $60k trades, this keyword highlights how traders on Reddit and news from Bloomberg can impact stock trends.

It’s a story of regular people spotting chances, taking risks, and challenging the big players in finance. Stay tuned as these trends keep growing and making headlines!

READ MORE:

Leave a Reply